Breaking News

What Are Our Politicians Doing To Us?

This Is NOT The Last Rodeo For Neal McDonough | #437 | The Way I Heard It

This Is NOT The Last Rodeo For Neal McDonough | #437 | The Way I Heard It

James Comer Wants Depositions From People Who Had 'Influence' Over Biden and Were 'Possi

James Comer Wants Depositions From People Who Had 'Influence' Over Biden and Were 'Possi

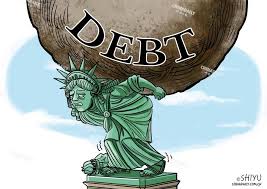

What Really Solves America's Debt Woes--And Why Rate Caps Aren't It

What Really Solves America's Debt Woes--And Why Rate Caps Aren't It

Top Tech News

Cavorite X7 makes history with first fan-in-wing transition flight

Cavorite X7 makes history with first fan-in-wing transition flight

Laser-powered fusion experiment more than doubles its power output

Laser-powered fusion experiment more than doubles its power output

Watch: Jetson's One Aircraft Just Competed in the First eVTOL Race

Watch: Jetson's One Aircraft Just Competed in the First eVTOL Race

Cab-less truck glider leaps autonomously between road and rail

Cab-less truck glider leaps autonomously between road and rail

Can Tesla DOJO Chips Pass Nvidia GPUs?

Can Tesla DOJO Chips Pass Nvidia GPUs?

Iron-fortified lumber could be a greener alternative to steel beams

Iron-fortified lumber could be a greener alternative to steel beams

One man, 856 venom hits, and the path to a universal snakebite cure

One man, 856 venom hits, and the path to a universal snakebite cure

Dr. McCullough reveals cancer-fighting drug Big Pharma hopes you never hear about…

Dr. McCullough reveals cancer-fighting drug Big Pharma hopes you never hear about…

EXCLUSIVE: Raytheon Whistleblower Who Exposed The Neutrino Earthquake Weapon In Antarctica...

EXCLUSIVE: Raytheon Whistleblower Who Exposed The Neutrino Earthquake Weapon In Antarctica...

Doctors Say Injecting Gold Into Eyeballs Could Restore Lost Vision

Doctors Say Injecting Gold Into Eyeballs Could Restore Lost Vision

What Really Solves America's Debt Woes--And Why Rate Caps Aren't It

Many stumble, however, in applying this same criticism to other forms of price controls, such as interest rate caps, which have been revived earlier this year.

The following article was originally published by the Mises Institute. The opinions expressed do not necessarily reflect those of Peter Schiff or SchiffGold.

Nothing brings Republicans and Democrats together like using simplistic, heavy-handed government regulations to attempt to solve complex problems. Unfortunately, the promise of easy solutions blinds policymakers to much more effective alternatives.

Recent proposals to cap credit card rates are a good example. In February, Republican Josh Hawley and socialist Bernie Sanders proposed a Senate bill that, if passed, would cap rates on credit cards at 10 percent. In March, Republican Anna Paulina Luna and Democrat Alexandria Ocasio-Cortez introduced a similar bill in the house that would establish the same rate maximum.

As enticing as this simple and allegedly easy fix might sound, it will actually make America's debt problem worse. Rather than relieving their debt burdens, a rate cap will end up costing people access to their credit cards altogether, driving them to payday loans and other much less desirable credit arrangements. Instead of passing a counterproductive rate max, the government should focus on things that would actually provide Americans some financial relief, like extending the 2017 Tax Cuts and Jobs Act (TCJA) and reducing tariffs. These measures would save the average American more money than the potential savings from a credit card rate cap.

Set to expire later this year, the TCJA has been very beneficial for working Americans. Passed during Trump's first term, the TCJA substantially lowered the corporate income tax rate from 35 percent to 21 percent. Though often maligned as "trickle down" economics, reducing taxes on corporations did indirectly help everyday Americans. Since businesses were able to retain more of their earnings, they invested more by expanding their operations, hiring more employees, and raising wages.

According to the Cato Institute, the average production and non-supervisory worker saw their wages go up about $1,400 per year as a result of increased economic investment. The benefits aren't just temporary. One study found that extending the 2017 tax cuts would boost incomes for individuals across the board, with the bottom quintile receiving a 2.8 percent increase.

Unfortunately, the Trump administration is threatening to undo these gains by raising tariffs. Given Trump's erratic behavior lately, it's impossible to tell just how much his new tariffs will cost, but a few economists have provided good estimates. If the president's April 9 revisions hold, the new import tax rates could cost American households as much as $4,400 per year.

This is far more than the potential savings from an interest rate cap. The average cardholder has a balance of $7,236 and the average rate is 21.37 percent, meaning that the typical monthly interest charge is $128.18. Forcibly lowering rates to 10 percent would generate an interest charge of $59.71, meaning that the average cardholder would potentially save $821.64 annually. This is far less than what Americans could obtain by extending the 2017 tax cuts or rescinding Trump's new tariffs.