Breaking News

Poland to Buy 150 Tons More Gold, Approves up to 36.6% Held

Poland to Buy 150 Tons More Gold, Approves up to 36.6% Held

Michael Oliver: T-Bond Nuclear Panic Will Send Silver VIOLENTLY to $300–$500 | Gold to $8,000

Michael Oliver: T-Bond Nuclear Panic Will Send Silver VIOLENTLY to $300–$500 | Gold to $8,000

Greentanamo: Trump Deal Gives US Sovereignty Over Small Pockets Of Greenland For Military Bases

Greentanamo: Trump Deal Gives US Sovereignty Over Small Pockets Of Greenland For Military Bases

Das: Trump's Spat With The Fed Is Not About Central Bank Independence

Das: Trump's Spat With The Fed Is Not About Central Bank Independence

Top Tech News

The day of the tactical laser weapon arrives

The day of the tactical laser weapon arrives

'ELITE': The Palantir App ICE Uses to Find Neighborhoods to Raid

'ELITE': The Palantir App ICE Uses to Find Neighborhoods to Raid

Solar Just Took a Huge Leap Forward!- CallSun 215 Anti Shade Panel

Solar Just Took a Huge Leap Forward!- CallSun 215 Anti Shade Panel

XAI Grok 4.20 and OpenAI GPT 5.2 Are Solving Significant Previously Unsolved Math Proofs

XAI Grok 4.20 and OpenAI GPT 5.2 Are Solving Significant Previously Unsolved Math Proofs

Watch: World's fastest drone hits 408 mph to reclaim speed record

Watch: World's fastest drone hits 408 mph to reclaim speed record

Ukrainian robot soldier holds off Russian forces by itself in six-week battle

Ukrainian robot soldier holds off Russian forces by itself in six-week battle

NASA announces strongest evidence yet for ancient life on Mars

NASA announces strongest evidence yet for ancient life on Mars

Caltech has successfully demonstrated wireless energy transfer...

Caltech has successfully demonstrated wireless energy transfer...

The TZLA Plasma Files: The Secret Health Sovereignty Tech That Uncle Trump And The CIA Tried To Bury

The TZLA Plasma Files: The Secret Health Sovereignty Tech That Uncle Trump And The CIA Tried To Bury

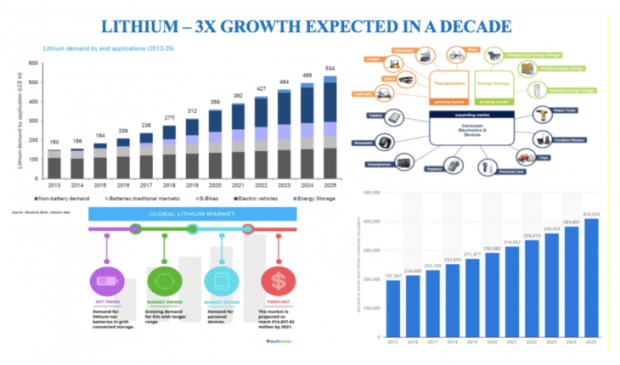

Tech Breakthrough Will Save The Electric Car Market

The global battery market is set to hit $120 billion in less than two years, and there's a massive investor opportunity here in lithium—but this isn't a mining play, it's a tech play all the way.

As lithium continues to enjoy status as the hottest metal on the market, and as producers race to the finish line to bring new supply online, one little-known company just might hold technology that will give it a big edge.?

In the swarm of new entrants on the lithium playing field, International Battery Metals (CSE:IBAT; OTC: RHHNF) stands out—front and center—because it's sitting on a proprietary advanced technology that could push lithium into the production stage rapidly. It has signed an LOI with North American Lithium (NAL) to acquire all its lithium extraction process intellectual property and be restructured with NAL becoming an integral part of the company.

Where traditional solar evaporation technology takes up to 24 months to extract lithium from the brine, IBAT incoming CEO Burba says he can do it in 24 hours. That would put IBAT on the front line of new lithium coming online to meet the battery demand. And that demand is supplying our energy transition for everything from mainstreamed electric vehicles (EVs) to massive energy storage solutions and consumer electronics market that grows leaps and bounds.

Nano Nuclear Enters The Asian Market

Nano Nuclear Enters The Asian Market