Breaking News

From Inflation to Hyperinflation: The Gathering Monetary Hurricane

From Inflation to Hyperinflation: The Gathering Monetary Hurricane

Deputy Attorney General Todd Blanche Fired Ed Martin as Chief of DOJ's Weaponization...

Deputy Attorney General Todd Blanche Fired Ed Martin as Chief of DOJ's Weaponization...

Clintons Bend The Knee To Comer, Agree To Testify In House Epstein Inquiry

Clintons Bend The Knee To Comer, Agree To Testify In House Epstein Inquiry

White House Ignores Congress -Hands More Weapons To Israelis & Saudis

White House Ignores Congress -Hands More Weapons To Israelis & Saudis

Top Tech News

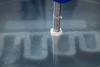

How underwater 3D printing could soon transform maritime construction

How underwater 3D printing could soon transform maritime construction

Smart soldering iron packs a camera to show you what you're doing

Smart soldering iron packs a camera to show you what you're doing

Look, no hands: Flying umbrella follows user through the rain

Look, no hands: Flying umbrella follows user through the rain

Critical Linux Warning: 800,000 Devices Are EXPOSED

Critical Linux Warning: 800,000 Devices Are EXPOSED

'Brave New World': IVF Company's Eugenics Tool Lets Couples Pick 'Best' Baby, Di

'Brave New World': IVF Company's Eugenics Tool Lets Couples Pick 'Best' Baby, Di

The smartphone just fired a warning shot at the camera industry.

The smartphone just fired a warning shot at the camera industry.

A revolutionary breakthrough in dental science is changing how we fight tooth decay

A revolutionary breakthrough in dental science is changing how we fight tooth decay

Docan Energy "Panda": 32kWh for $2,530!

Docan Energy "Panda": 32kWh for $2,530!

Rugged phone with multi-day battery life doubles as a 1080p projector

Rugged phone with multi-day battery life doubles as a 1080p projector

4 Sisters Invent Electric Tractor with Mom and Dad and it's Selling in 5 Countries

4 Sisters Invent Electric Tractor with Mom and Dad and it's Selling in 5 Countries

'Rock Now Beats Paper': Making Sense Of "Silver Friday's" Utterly Rigged Nonse

The Great (Yet Familiar) Fall

Despite no change whatsoever in global supply and demand forces, silver went from a $120 near-high on Thursday to a $78 low on Friday, marking this as the largest single-day crash (35%) in the silver market in 44 years.

It goes without saying that such price moves don't happen naturally.

Something far more engineered was in play, a trick which many investors may not immediately recognize, but which anyone familiar with the nefarious insider mechanics of banking, the Chicago Mercantile Exchange, the COMEX and the London Bullion Market Association can see as plainly as a dentist sees a cavity.

So, what happened?

Look No Further than a Banker's Rescue

As usual, whenever something so openly rigged, insider and market-distorting occurs, the very first place to look for a smoking gun, guilty child and a liar's grin is among the banks, most of whom are and were drowning in levered silver short positions by Thursday night's $120 silver price.

This meant that with each passing day of rising silver, the banks were getting squeezed to the point of self-destruction.

This is not fable but fact. Rising silver was literally strangling the big banks. They needed to exit their short squeeze as soon as possible, but preferably at a lower rather than higher silver price.

And then, almost by magic, silver conveniently fell like a rock to save their collectively levered @$$es.

Coincidences Galore…

But was it really any "magical" coincidence that JP Morgan was able to exit its massive (and fatally stupid) short exposure at the absolute bottom/floor of the silver price on Friday? That is, at the perfect moment?

Was it also any coincidence that the London Metals Exchange went completely dark on that very same day?

And was it just an equal coincidence that HSBC, the second largest silver short holder on the LBMA, went completely offline as the choreographed Friday massacre in silver took place?