Breaking News

When flipping margins fall below 25%, risk doesn't disappear.

When flipping margins fall below 25%, risk doesn't disappear.

Weird, I Thought They Could Only Redact The Victims - Clip

Weird, I Thought They Could Only Redact The Victims - Clip

Lucid: Drone Flyover Shows Record 27 Car Haulers at Arizona Factory

Lucid: Drone Flyover Shows Record 27 Car Haulers at Arizona Factory

The Food Math Nobody Does (But Should)

The Food Math Nobody Does (But Should)

Top Tech News

EngineAI T800: Born to Disrupt! #EngineAI #robotics #newtechnology #newproduct

EngineAI T800: Born to Disrupt! #EngineAI #robotics #newtechnology #newproduct

This Silicon Anode Breakthrough Could Mark A Turning Point For EV Batteries [Update]

This Silicon Anode Breakthrough Could Mark A Turning Point For EV Batteries [Update]

Travel gadget promises to dry and iron your clothes – totally hands-free

Travel gadget promises to dry and iron your clothes – totally hands-free

Perfect Aircrete, Kitchen Ingredients.

Perfect Aircrete, Kitchen Ingredients.

Futuristic pixel-raising display lets you feel what's onscreen

Futuristic pixel-raising display lets you feel what's onscreen

Cutting-Edge Facility Generates Pure Water and Hydrogen Fuel from Seawater for Mere Pennies

Cutting-Edge Facility Generates Pure Water and Hydrogen Fuel from Seawater for Mere Pennies

This tiny dev board is packed with features for ambitious makers

This tiny dev board is packed with features for ambitious makers

Scientists Discover Gel to Regrow Tooth Enamel

Scientists Discover Gel to Regrow Tooth Enamel

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Vitamin C and Dandelion Root Killing Cancer Cells -- as Former CDC Director Calls for COVID-19...

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

Galactic Brain: US firm plans space-based data centers, power grid to challenge China

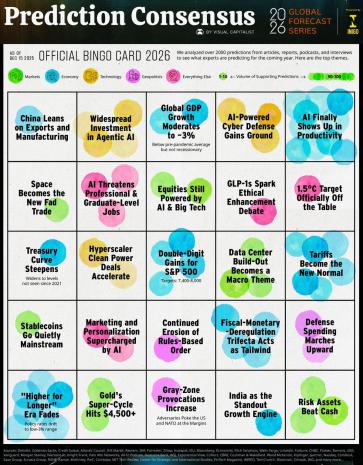

Prediction Consensus: What The Experts See Coming In 2026

This year, Nick Routley analyzed over 2,000 individual predictions from a wide variety of sources including Morgan Stanley, Goldman Sachs, the IMF, The Economist, Deloitte, Microsoft, Gartner, and dozens more.

By mapping where these forecasts overlap, we've distilled the noise into 25 high-conviction themes displayed in our "Bingo Card" format, with the number of dabs reflecting the volume of supporting predictions.

The General Vibe of 2026

If 2025 was a year of adjustment - markets recalibrating to higher rates, geopolitics reshuffling around a second Trump administration and tariffs, and AI moving from hype to deployment - then 2026 is shaping up as a year of consolidation and consequence.

The consensus mood is cautiously optimistic but shot through with uncertainty. Morgan Stanley describes 2026 as "The Year of Risk Reboot," a period where market focus shifts from macro anxieties to micro fundamentals, creating fertile ground for risk assets. The policy backdrop is unusually supportive: fiscal stimulus, continued (if slower) monetary easing, and deregulation form what analysts call a "policy triumvirate" rarely seen outside of recessions.

Yet The Economist strikes a more sober tone, warning that 2026 will be defined by uncertainty as Trump's reshaping of geopolitical norms continues to ripple worldwide. The old rules-based order is drifting further, and the line between war and peace grows ever more blurred through gray-zone provocations, cyber incursions, and an ambient rivalry between nations.

In short: risk assets may thrive, but the world beneath them remains turbulent.

AI: Once Again, the Big Story

For the third consecutive year, artificial intelligence dominates the prediction landscape, but the narrative has evolved. Where 2024 forecasts centered on whether AI hype was justified and 2025 focused on deployment at scale, the 2026 conversation is about integration and consequences.

From Tool to Partner

Across industries, AI is moving beyond answering questions to actively collaborating with people and amplifying their expertise.

This is the year of the agentic AI build-out. Deloitte predicts that by year-end 2026, as many as 75% of companies may be investing in agentic AI (autonomous systems that can plan, act, and adapt with limited human oversight). These AI agents are set to become "digital colleagues," helping small teams punch above their weight. Microsoft envisions a future where a three-person marketing team can launch a global campaign in days, with AI handling data crunching and content generation while humans steer strategy.