Breaking News

Masked Muslim youths take to east London streets to 'defend our community' after police bann

Masked Muslim youths take to east London streets to 'defend our community' after police bann

Why Owning Gold and Silver Is More Critical Than Ever

Why Owning Gold and Silver Is More Critical Than Ever

Redfin, Realtor, Reality: Signs of a Housing Shift

Redfin, Realtor, Reality: Signs of a Housing Shift

China's $2.6b Belt and Road Battery project in Australia paid for by our taxpayers

China's $2.6b Belt and Road Battery project in Australia paid for by our taxpayers

Top Tech News

Why 'Mirror Life' Is Causing Some Genetic Scientists To Freak Out

Why 'Mirror Life' Is Causing Some Genetic Scientists To Freak Out

Retina e-paper promises screens 'visually indistinguishable from reality'

Retina e-paper promises screens 'visually indistinguishable from reality'

Scientists baffled as interstellar visitor appears to reverse thrust before vanishing behind the sun

Scientists baffled as interstellar visitor appears to reverse thrust before vanishing behind the sun

Future of Satellite of Direct to Cellphone

Future of Satellite of Direct to Cellphone

Amazon goes nuclear with new modular reactor plant

Amazon goes nuclear with new modular reactor plant

China Is Making 800-Mile EV Batteries. Here's Why America Can't Have Them

China Is Making 800-Mile EV Batteries. Here's Why America Can't Have Them

China Innovates: Transforming Sand into Paper

China Innovates: Transforming Sand into Paper

Millions Of America's Teens Are Being Seduced By AI Chatbots

Millions Of America's Teens Are Being Seduced By AI Chatbots

Transhumanist Scientists Create Embryos From Skin Cells And Sperm

Transhumanist Scientists Create Embryos From Skin Cells And Sperm

Redfin, Realtor, Reality: Signs of a Housing Shift

This past weekend, I was driving home from running errands when I was thrown off by what had once been a common sight. Driving through a familiar neighborhood, I saw multiple "For Sale" signs. Then, earlier this week, while taking my son to soccer practice, I saw the same thing on the other side of town.

The images stuck with me because they stood in stark contrast to just a few years ago. Now, don't get me wrong, it's not like there's a sign in every yard. But to see a small cluster after barely seeing any for so long? That's a clear sign the tide is turning.

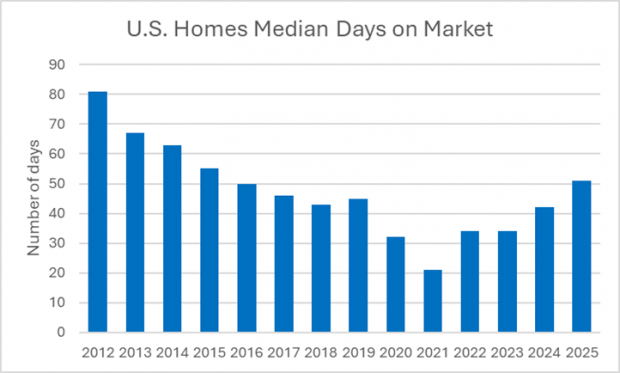

Recently, I was digging through Redfin's monthly housing metrics and saw that homes are now selling at one of the slowest paces in a decade. In September, properties sat on the market for an average of 51 days. That's not just a slowdown, it's a reset. For context: last year it was 42 days, and in 2021, just 21. The last time we saw this kind of stagnation was back in 2015, when the average was 55 days.

The National Association of Realtors ("NAR") confirmed the trend yesterday. Existing home sales held steady at an annualized pace of 4.06 million—still stuck at the bottom of a multi-year range.

And the reason behind the slowdown? The COVID-era mortgage boom.

Thanks to ultra-low interest rates at the time, nearly 78% of homeowners hold mortgages below 5%, with 59% under 4%, and 22% locked in under 3%, according to Goldman Sachs. Compare that to today's 6.3% rate on a conventional 30-year mortgage. Sellers don't want to give up their low rates and payments. Buyers don't want to pay up for new ones. Homeowners are more likely to refinance than to pack up and move. Until borrowing costs drop enough to change that equation, inventory is likely to build.

You've Never Seen Tech Like This

You've Never Seen Tech Like This