Breaking News

SpaceX will launch next Starship flight in 'about 3 weeks,' Elon Musk says

SpaceX will launch next Starship flight in 'about 3 weeks,' Elon Musk says

Nicotine pouch poisoning in young children surges 760% as FDA-approved products raise...

Nicotine pouch poisoning in young children surges 760% as FDA-approved products raise...

How America's entertainment industry manufactured silence on Gaza

How America's entertainment industry manufactured silence on Gaza

Organ harvesting exposed: The chilling reality of 'brain death' and how hospitals profit...

Organ harvesting exposed: The chilling reality of 'brain death' and how hospitals profit...

Top Tech News

Magic mushrooms may hold the secret to longevity: Psilocybin extends lifespan by 57%...

Unitree G1 vs Boston Dynamics Atlas vs Optimus Gen 2 Robot– Who Wins?

Unitree G1 vs Boston Dynamics Atlas vs Optimus Gen 2 Robot– Who Wins?

LFP Battery Fire Safety: What You NEED to Know

LFP Battery Fire Safety: What You NEED to Know

Final Summer Solar Panel Test: Bifacial Optimization. Save Money w/ These Results!

Final Summer Solar Panel Test: Bifacial Optimization. Save Money w/ These Results!

MEDICAL MIRACLE IN JAPAN: Paralyzed Man Stands Again After Revolutionary Stem Cell Treatment!

MEDICAL MIRACLE IN JAPAN: Paralyzed Man Stands Again After Revolutionary Stem Cell Treatment!

Insulator Becomes Conducting Semiconductor And Could Make Superelastic Silicone Solar Panels

Insulator Becomes Conducting Semiconductor And Could Make Superelastic Silicone Solar Panels

Slate Truck's Under $20,000 Price Tag Just Became A Political Casualty

Slate Truck's Under $20,000 Price Tag Just Became A Political Casualty

Wisdom Teeth Contain Unique Stem Cell That Can Form Cartilage, Neurons, and Heart Tissue

Wisdom Teeth Contain Unique Stem Cell That Can Form Cartilage, Neurons, and Heart Tissue

Hay fever breakthrough: 'Molecular shield' blocks allergy trigger at the site

Hay fever breakthrough: 'Molecular shield' blocks allergy trigger at the site

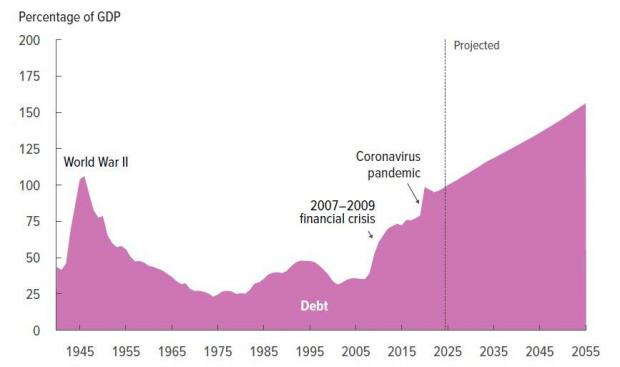

Senate Version Of Trump Tax Bill Adds $3.3 Trillion To Deficit, $500BN More Than The House;

The Senate version of President Trump's Big, Beautiful Bill (BBB) will add nearly $3.3 trillion to US deficits over a decade, according to the latest estimate from the Congressional Budget Office, half a trillion more than the $2.8 trillion in deficit expansion under the House version of the same bill. That's from a starting point with debt to GDP already in excess of 120% and the fiscal deficit sitting close to a peacetime record.

The CBO score for the so-called One Big Beautiful Bill reflects a $4.5 trillion decrease in revenues (i.e. tax cuts relative to the pre-TCJA baseline) and a $1.2 trillion decrease in spending through 2034, relative to a current law baseline.

The Senate bill, by Republican request, was also scored as saving $508 billion over a decade relative to a current policy baseline. The party's lawmakers have sought to use the accounting maneuver to permanently extend President Donald Trump's 2017 income-tax cuts, and score them as costing nothing.

While this approach is expected to pass, it effectively dooms the US to debt collapse as every subsequent administration will use the same tactic from now on and pretend that trillions in incremental spending every 4 years are really just an extension of the baseline. Meanwhile, the US is set to hit $40 trillion in debt in less than 2 years.

What does this mean? It means that Senate Republicans slapped a price tag on their tax package that is nearly 90% lower than the version that recently passed the House. They didn't bring the price down by changing the policies in the One Big Beautiful Bill. Instead, the Senate simply changed the way they did the math.

Senate Republicans are using a new method to estimate the costs of their tax package that ignores the price of continuing any tax policy in effect when the bill is passed. That method of accounting, called the "current policy" baseline, lets the Senate advertise President Donald Trump's tax package at one-tenth of its impact on the nation's finances as estimated by Congress's usual way of counting costs. If the costs were estimated in the traditional way, the Senate's proposed tax package would add $4.2 trillion to the national debt, according to preliminary estimates from the nonpartisan Committee for a Responsible Federal Budget.

AI Getting Better at Medical Diagnosis

AI Getting Better at Medical Diagnosis