Breaking News

Back to cash: life without money in your pocket is not the utopia Sweden hoped

Back to cash: life without money in your pocket is not the utopia Sweden hoped

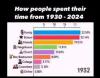

How people spent their time from 1930 - 2024

How people spent their time from 1930 - 2024

Superwood is Here! This Amazing New Material Could Change The World!

Superwood is Here! This Amazing New Material Could Change The World!

If only we'd built those offshore wind turbines, eaten more cricket-burgers...

If only we'd built those offshore wind turbines, eaten more cricket-burgers...

Top Tech News

New AI data centers will use the same electricity as 2 million homes

New AI data centers will use the same electricity as 2 million homes

Is All of This Self-Monitoring Making Us Paranoid?

Is All of This Self-Monitoring Making Us Paranoid?

Cavorite X7 makes history with first fan-in-wing transition flight

Cavorite X7 makes history with first fan-in-wing transition flight

Laser-powered fusion experiment more than doubles its power output

Laser-powered fusion experiment more than doubles its power output

Watch: Jetson's One Aircraft Just Competed in the First eVTOL Race

Watch: Jetson's One Aircraft Just Competed in the First eVTOL Race

Cab-less truck glider leaps autonomously between road and rail

Cab-less truck glider leaps autonomously between road and rail

Can Tesla DOJO Chips Pass Nvidia GPUs?

Can Tesla DOJO Chips Pass Nvidia GPUs?

Iron-fortified lumber could be a greener alternative to steel beams

Iron-fortified lumber could be a greener alternative to steel beams

One man, 856 venom hits, and the path to a universal snakebite cure

One man, 856 venom hits, and the path to a universal snakebite cure

Dr. McCullough reveals cancer-fighting drug Big Pharma hopes you never hear about…

Dr. McCullough reveals cancer-fighting drug Big Pharma hopes you never hear about…

Billionaire Investor Bill Ackman Explains Why Harvard is Panicked – Their Endowment...

Earlier this month, Bill Ackman made it clear that he is on Trump's side in his ongoing battle with Harvard. He correctly suggested that Harvard has become "a political advocacy organization for one party."

One of the reasons why Harvard is in a panic over this fight is because their famously huge endowment is not nearly the financial powerhouse people think it is. It may be large, but it's not liquid.

Ackman recently broke it down in a lengthy post on Twitter/X:

I believe it is likely @Harvard's that financial position is overstated by the media and the general public. I believe this is principally for two reasons.

One, people ignore Harvard's $7.9 billion of debt outstanding, which is likely to increase in order for Harvard to meet its cash needs due to the loss of government funding and reduced alumni gifts.

Second, Harvard's endowment is principally invested in illiquid private assets including real estate, private equity, and venture capital funds.

Real estate and private equity funds are highly levered so relatively small changes in asset values can have a large impact on equity values. For example, if a real estate fund's asset values decline by 15% and the assets are levered 60%, the fund's equity value will decline by 37.5%…

In my interview with @nfergus below, I said the realizable values of Harvard's private assets could be as low 40% of current carrying values if Harvard needs to liquidate substantial portions of its assets to meet its obligations.

I am told by an expert I highly respect in this space that my 40% discount is much too high and a 7% – 15% discount is a better estimate.

Watch as Ackman analyzes the real value of Harvard's endowment below:

Bill Ackman: "One thing I believe is that the private equity, venture capital and real estate portfolios are mismarked"

— Boring_Business (@BoringBiz_) May 22, 2025

Ackman on Harvard and Yale endowment's exposure to private equity and VC. One of the best clips I have seen

From his recent interview at University of Austin pic.twitter.com/MZN2CpITDN