Breaking News

Battleborn Batteries Responds! Their Overheating Device is a "Feature" not a "Problem

Battleborn Batteries Responds! Their Overheating Device is a "Feature" not a "Problem

Actor Liam Neeson Outs Himself as MAHA After Narrating Pro-RFK Jr. Documentary Slamming...

Actor Liam Neeson Outs Himself as MAHA After Narrating Pro-RFK Jr. Documentary Slamming...

Kyle Rittenhouse announced on social media Wednesday that he has tied the knot.

Kyle Rittenhouse announced on social media Wednesday that he has tied the knot.

JUST IN: President Trump Grants Tina Peters Pardon

JUST IN: President Trump Grants Tina Peters Pardon

Top Tech News

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Build a Greenhouse HEATER that Lasts 10-15 DAYS!

Look at the genius idea he came up with using this tank that nobody wanted

Look at the genius idea he came up with using this tank that nobody wanted

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Latest Comet 3I Atlas Anomolies Like the Impossible 600,000 Mile Long Sunward Tail

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Tesla Just Opened Its Biggest Supercharger Station Ever--And It's Powered By Solar And Batteries

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

Your body already knows how to regrow limbs. We just haven't figured out how to turn it on yet.

We've wiretapped the gut-brain hotline to decode signals driving disease

We've wiretapped the gut-brain hotline to decode signals driving disease

3D-printable concrete alternative hardens in three days, not four weeks

3D-printable concrete alternative hardens in three days, not four weeks

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

Could satellite-beaming planes and airships make SpaceX's Starlink obsolete?

Japan Enters Its Death Spiral

Japan has been a big topic in this newsletter because it illustrates the no-win situation in which wildly overindebted countries eventually find themselves. Here are two articles that illustrate the point:

How a Country Goes Bankrupt, In 10 Steps

Now For The Death Spiral

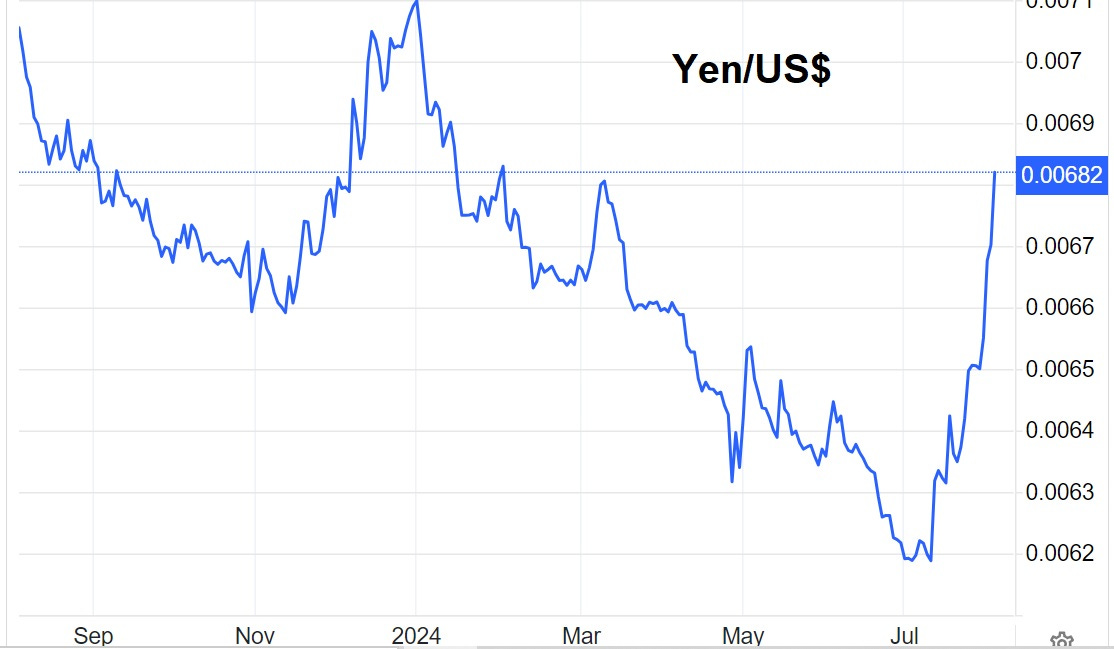

Confronted with both a plunging yen and rising interest rates, Japan was recently forced to address one of those potential crises. It chose to protect the yen by raising short-term interest rates and using the dollars in its foreign exchange reserve to buy yen. This arrested the yen's decline:

But remember, Japan is in a box where fixing one crisis exacerbates one or more others. In this case, a resurgent yen makes Japanese exports more expensive, threatening to tip the economy into recession. Japanese stocks, in response, are now plunging

First totally synthetic human brain model has been realized

First totally synthetic human brain model has been realized Mach-23 potato gun to shoot satellites into space

Mach-23 potato gun to shoot satellites into space