Breaking News

EXCLUSIVE: "The HUGE Elephant In The Room Is Actually What Jeffrey Epstein Was Best At..."

EXCLUSIVE: "The HUGE Elephant In The Room Is Actually What Jeffrey Epstein Was Best At..."

EXCLUSIVE INTERVIEW: Republican Candidate For Texas Governor "Doc" Pete Chambers Joins...

EXCLUSIVE INTERVIEW: Republican Candidate For Texas Governor "Doc" Pete Chambers Joins...

Epstein Files Trigger Political Fallout Across Europe

Epstein Files Trigger Political Fallout Across Europe

Conjoined twin 'influencers' who have gained more than 280,000 followers with their intimate

Conjoined twin 'influencers' who have gained more than 280,000 followers with their intimate

Top Tech News

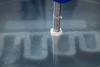

How underwater 3D printing could soon transform maritime construction

How underwater 3D printing could soon transform maritime construction

Smart soldering iron packs a camera to show you what you're doing

Smart soldering iron packs a camera to show you what you're doing

Look, no hands: Flying umbrella follows user through the rain

Look, no hands: Flying umbrella follows user through the rain

Critical Linux Warning: 800,000 Devices Are EXPOSED

Critical Linux Warning: 800,000 Devices Are EXPOSED

'Brave New World': IVF Company's Eugenics Tool Lets Couples Pick 'Best' Baby, Di

'Brave New World': IVF Company's Eugenics Tool Lets Couples Pick 'Best' Baby, Di

The smartphone just fired a warning shot at the camera industry.

The smartphone just fired a warning shot at the camera industry.

A revolutionary breakthrough in dental science is changing how we fight tooth decay

A revolutionary breakthrough in dental science is changing how we fight tooth decay

Docan Energy "Panda": 32kWh for $2,530!

Docan Energy "Panda": 32kWh for $2,530!

Rugged phone with multi-day battery life doubles as a 1080p projector

Rugged phone with multi-day battery life doubles as a 1080p projector

4 Sisters Invent Electric Tractor with Mom and Dad and it's Selling in 5 Countries

4 Sisters Invent Electric Tractor with Mom and Dad and it's Selling in 5 Countries

Good Money, Bad Money--And How Bitcoin Fits In

Let us start with talking about bad money, by which I mean the US dollar, the euro, the Japanese yen, the Chinese renminbi, the British pound, the Swiss franc, and basically all official currencies.

They all represent fiat money. The term fiat is derived from the Latin word fiat and means "so be it." Fiat money is "coercive money," or "money forced upon the people."

There are three major characteristics of fiat money:

The state (or its agent, the central bank) has a monopoly on money production.

Fiat money is produced through bank credit expansion; it is literally created out of thin air.

Fiat money is intrinsically valueless. It is just brightly colored paper and intangible bits and bytes that can be produced at any time and in any amount deemed politically expedient.

How We Got Bad Money

Just in passing, I would like to let you know that fiat money has not come into this world naturally. States have worked long and hard to replace commodity money in the form of gold and silver with their own fiat money.

The final blow to commodity money came on August 15, 1971: US President Richard Nixon announced that the US dollar would no longer be convertible into gold. This very decision (which I like to call the greatest monetary expropriation in modern history) effectively put the world on a fiat money regime.